23 Mar Hybrid and Balanced Funds Meaning, Types, Expense Ratio, Taxation

Contents:

Investments from different investors are pooled together to create a collective corpus for the conservative hybrid fund. With hybrid funds, investors with different risk tolerances can choose how they want to invest their money. They offer higher returns than debt funds and have been shown to perform at par with equity funds as well. Hybrid mutual funds offer dual benefits of debt and equity to investors and help diversify the portfolio.

What Are Balanced Advantage Funds? – Forbes Advisor INDIA – Forbes

What Are Balanced Advantage Funds? – Forbes Advisor INDIA.

Posted: Thu, 22 Sep 2022 07:00:00 GMT [source]

Multi-asset allocation funds are the perfect way for retail investors as they capture the growth of all asset classes. As you can see, aggressive hybrid funds have generated the highest return across the short term and long-term . Equity mutual fund schemes provide returns with higher risk, ideal for investors who don’t mind taking the risk of capital and expect inflation-beating returns over the long term. Hybrid funds invest in both equity securities and debt instruments depending on the investment objective. These funds are ideal for investors who aim for diversification of funds, risk, and return. Upon redemption of units after 3 years, long term capital gains are earned by investors.

What are debt funds?

As you can see, each of these three mutual funds serve different goals. So, make sure to take your goals and your risk appetite into account, when choosing the fund that you wish to invest in. The taxation of dynamic hybrid fund changes as per change in changes in allocation. If the fund manager keeps the entire corpus in debt, debt taxation will apply or else equity taxation is applicable.

For debt-oriented hybrid funds, LTCG applies to profits made after three years from the investment date. The LTCG for equity funds is 10%, and the LTCG for debt funds is 20% . A hybrid fund is a special type of mutual fund that allows you to invest in two or more popular capital and commodity market instruments.

Monthly Income Plans (MIPs)

Equity-oriented funds held for less than one year are liable to a short-term capital gains tax of 15%. A debt mutual fund will invest 100% of its corpus in debt instruments. Whereas a hybrid mutual fund will invest in equity, debt and gold. Exit load is applicable is you redeem from a fund before a specific period of time. But unlike equity funds, different types of hybrid funds have different exit load periods.

WeWork Announces Expiration and Final Results of the Exchange … – Business Wire

WeWork Announces Expiration and Final Results of the Exchange ….

Posted: Tue, 02 May 2023 12:00:00 GMT [source]

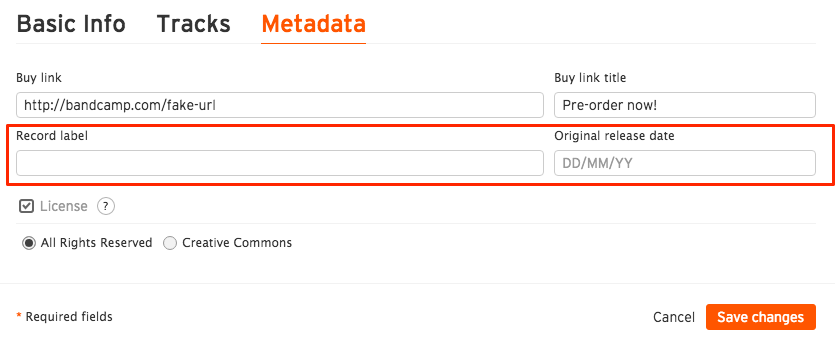

Typically, the hybrid fund meaningments are made in a mix of equity and fixed income instruments. Investors who are willing to take greater risk may invest in aggressive hybrid funds. These have an equity orientation, investing in more equity securities than debt instruments. Sebi’s guidance dictates these allocate anywhere between percent assets in equity and equity-related products. Historically these funds have provided a return in the range of 7 – 8 % on average. Another type of hybrid mutual fund is the dynamic asset allocation fund, which changes the mix of equity and debt in its portfolio according to the demands of the situation.

Juzer Gabajiwala- Director, Ventura Securities

Typically, conservative hybrid mutual funds are best suited for the following types of investors. Hybrid funds are a type of mutual fund that is typically a combination of equity and debt investments. In essence, a hybrid fund invests in two or more asset classes and diversifies across a mix of bonds, stocks, commodities and other securities.

The term ‘hybrid’ itself indicates that the portfolio invests in multiple asset classes. The rationale behind investing in hybrid funds is to make sure that the investment has a stability of return and achieve diversification benefits at the same time. But in achieving these objectives with the help of hybrid funds, we end up paying an expense ratio of around 0.90 – 1.10 percent on an average which later on eats into our returns.

Nearly $100M earmarked to study how tech can help immigrants … – pentictonherald.ca

Nearly $100M earmarked to study how tech can help immigrants ….

Posted: Fri, 05 May 2023 17:37:52 GMT [source]

Hence, evaluating the pros and cons of hybrid funds is a must before committing to them. Long-Term Capital Gains Tax – LTCG is different for equity and debt funds. For equity-oriented hybrid funds, LTCG applies to profits made after one year from the investment date.

However, the risk Factor is much higher in a balanced fund than Monthly Income Plan . These funds charge an annual fee for providing you with their fund management services. Look for an aggressive hybrid fund with a low expense ratio, as high expense ratios cut into the fund’s profits. Consider selecting a direct plan offered by the fund as it might provide you with greater returns than a regular plan. If the fund is held for beyond a year, it will attract a long-term capital gains tax at the rate of 10%. However, yields of up to Rs. 1 lakh in a financial year are exempted from tax in the given financial year.

You can either do your own allocation to equity, debt and derivatives or you can rely on a hybrid fund. The hybrid fund is a formula based combination which combines debt, equity, gold and derivatives as the case may be in different proportions. The idea is to provide a complete palate of risk and return classes for different requirements. The tax rate for hybrid funds would be 15% if sold within one year and 10% if these are sold after one year vis-a-vis debt funds / FD which may be taxed at a higher rate of 39% to 43%. For the purpose of taxation, these funds are considered as non-equity oriented mutual fund schemes.

If you need regular income, then opting for a debt-oriented hybrid fund might offer better returns than a pure debt fund due to the added equity component. These funds invest a minimum of 65% of their total assets in equity and equity-related instruments and the rest in debt securities and cash. Further, new investors who are unsure about stepping into the equity markets tend to turn towards hybrid funds.

Hybrid funds can be actively managed or passively managed, and they are typically more flexible than other types of investment funds. Depending upon the proportion of investment in each asset class and the scheme’s objective, hybrid funds are of various types. To help you choose the right scheme, we have covered the necessary details regarding hybrid mutual funds.

A hybrid fund is considered a debt-oriented fund if more than 65% is allocated to debt instruments by the fund manager. The fund’s debt portion is the investment in fixed-income havens, such as government securities, debentures, shares, treasury bills, and so on. Some part of the fund would also be invested in cash and cash equivalents, for the sake of liquidity. It’s difficult to say which hybrid mutual fund is the best because the right choice for you will depend on your specific financial goals and risk tolerance. It’s generally a good idea to research and compare different options to find the one that aligns with your investment strategy.

Hybrid mutual funds may charge a percentage of NAV for entry or exit. The load structure of the scheme has to be disclosed in its offer documents by the AMC. Likewise, those who redeem their units on the same day and the exit load are applied, will get only INR 29.70 (Rs 30 – 1% of Rs 30 i.e. 0.30 Paise) per unit.

- Since Hybrid funds invest in both equities and debt securities, the tax treatment for these funds depends on the asset allocation of the funds.

- They seek to find a ‘balance’ between growth and income by investing in both equity and debt.

- This is the reason why it is ideal for investors who look for a balance of risk and rewards.

- It may invest 40-60% of the fund money in one asset class and the rest in the other.

Ltd. (“Smallcase”) over which UTI Mutual Fund has no control/influence (“3rd Party Gateway”). Any link you access/click to or from the 3rd Party Gateway will be solely at your own risk and consequences. Taxation depends on which asset class is the fund majorly exposed to.

Aggressive Hybrid Fund invests 65% – 80% in equity shares and 20% -35% in debt instruments. Equity-oriented hybrid funds include Aggressive hybrid funds, Arbitrage funds, and Equity Savings funds. The main goal of the fund manager is to benefit from price appreciation in all three asset classes while balancing the risk.

Premium Securities like mutual funds that have debt or equity proportions exceeding 35% but below 65% are considered hybrid securities. – Since mutual funds invest own funds, the difference is fully the return. This diversity allows portfolio managers to potentially balance risk with reward and deliver steady, long-term returns for investors, particularly in volatile markets. Multi-asset funds may invest in a number of traditional equity and fixed income strategies, index-tracking funds, financial derivatives as well as commodity like gold. They seek to find a ‘balance’ between growth and income by investing in both equity and debt. Short term debt funds have to also be evaluated for the credit risk they may take to earn higher coupon income.

Conservative Hybrid Fund – Such hybrid fund will invest predominantly in debt securities (75% to 90% of the portfolio) and the balance in equity securities. Their debt exposure makes these funds vulnerable to crises of liquidity when the security-issuing company defaults on its debt papers. The AMCs of such funds, holding these papers as part of their portfolio for investors take the hit, which can erode the investors’ money. The debt component provides a cushion against extreme market movements, and the equity component provides us an opportunity to earn high returns.

The dividend will be added to your net income and taxed accordingly. Credit Risk – If a hybrid fund chooses debt instruments with low credit ratings, the chances of default will be high. If a company defaults on the repayment of interest and/or principal, the fund value may decline substantially. Dynamic Asset Allocation Fund changes allocation dynamically as per market valuations. A high PE ratio means the fund is investing in overvalued or rich stocks. This usually happens when the fund is following a growth investing strategy.

The gains on pure debt funds are taxed at the investor’s income slab rate. On the other hand, hybrid funds which have a gross exposure of over 65% to equities are taxed as equity-oriented funds, where STCG is 15% while LTCG on capital gains exceeding INR 1 lac is 10%. Therefore, investors can maintain the desired portfolio mix between equity and debt but create a more tax-efficient portfolio by investing in appropriate hybrid funds. Equity-oriented funds, with more than 65 per cent in equities, have the same tax treatment as equity funds. If you hold them for less than a year, you pay 15 per cent capital gains tax.

- Some of the key investor profiles that benefit from these funds have been touched upon below.

- The equities can generate high returns but are also highly volatile whereas the debt can give stable returns at low risk.

- A small portion of this fund’s total assets is directed toward equity and equity-related instruments.

- On the other hand, the debt section helps provide stability and cushion the fund from an underperforming market.

- The tax rate for hybrid funds would be 15% if sold within one year and 10% if these are sold after one year vis-a-vis debt funds / FD which may be taxed at a higher rate of 39% to 43%.

- This is to bring uniformity in similar schemes launched by the different Mutual Funds.

Not to mention, hybrid funds allow investment via the SIP method, which is the most suitable method for the salaried class. Aggressive – These funds invest around 65% of the Asset Under Management in equity stocks and equity-related instruments and the remaining in debt instruments. The debt instruments can be corporate bonds, government securities, commercial papers, certificates of deposit, non-convertible debentures, etc. It invests minimum 40% of the corpus in equity shares and the remaining 60% in debt instruments. Aggressive, balanced advantage and arbitrage hybrid funds follow equity taxation.

An equity-oriented hybrid fund invests at least 65% of its total assets in equity and equity-related instruments of companies across various market capitalizations and sectors. Hybrid funds invest in multiple asset classes giving investors exposure to equity, debt, gold related instruments and other asset classes depending on the type of fund and its investment objective. This saves the investors the hassle of investing in each asset class separately while also reducing the cost involved for investing in each asset class-based fund. As the name suggests, Dynamic asset allocation fund dynamically invests in both equity and debt depending on the current market conditions based on an internal investment model. This fund is suitable for investors looking for better risk adjusted returns over long term irrespective of market conditions. Hybrid funds are mutual fund schemes that are characterized by diversification within two or more asset classes.

This is where hybrid funds come in handy, and reduce the unsystematic risk by investing in more than one asset class. For a conservative investor, a hybrid fund provides a stable portfolio of stocks as well as exposure to Fixed Income instruments. So, it is a very sensible long-term investment option that ensures a promising capital investment along with providing respectable returns in the later phase of life.