18 Oct Traceable and Common Fixed Costs Example

Content

As shown in Exhibit 5-3, the social media games division is profitable overall however only one of the product lines within that division is profitable. Segmented income statements provide detailed information for management to make informed decisions about particular segments within an organization. Common fixed costs are not allocated to a particular segment since they are common costs. Instead, common fixed costs are subtracted from the total company segment margin to arrive at net operating income. For Media Masters in Exhibit 5-2, the total divisional segment margin is $75,000.

- Some fixed costs that are considered traceable by one segment may be considered common costs by another segment.

- No single segment can be regarded as the sole reason of this cost.

- The chapter concepts are applied to comprehensive business scenarios in the below Practice Video Problems.

- On a contribution margin income statement, costs are classified as variable or fixed.

- You just lose out on some sales because you do all the special order.

Indirect labor costs – Salaries of production workers whose efforts usually are not directly traceable to the finished good, including personnel, quality-control workers, and inspectors. Distinguish between a traceable cost and a common cost. The formula to compute net operating income, sometimes referred to as net income or net profit, is the organization’s revenues less its expenses. For example, a company decides to buy a new piece of manufacturing equipment rather than lease it. For each cost object, mention one example of a direct cost and an indirect cost.

Traceable cost can become common cost:

Controllable costs are considered so when the decision of taking on the cost is made by one individual. Common examples of controllable costs are office supplies, advertising expenses, employee bonuses, and charitable donations. Controllable costs are categorized as short-term costs as they can be adjusted quickly. Sunk costs are historical costs that have already been incurred and will not make any difference in the current decisions by management.

Because a direct cost is traceable to a cost object, the cost is likely to be eliminated if the cost object is eliminated. For instance, if the plastics segment of a business closes down, the salary of the manager of that segment probably is eliminated. Sometimes a direct cost would remain even if the cost object were eliminated, but this is the exception rather than the rule. Traceable fixed costs are costs that can be traced directly to an organizational segment. Ba Boutique sells high-end, custom-made clothes. The company has two branch locations in Ohio, one in Cincinnati and one in Loveland.

Distinguish between a traceable fixed cost and a common fixed cost. Give several examples of each.

Usually, companies use costing methods and techniques to assign common costs to the responsibility centers. While still fixed, these costs may differ from one department to another based on the allocation basis used. In responsibility income statements, revenue is assigned to the profit center responsible traceable and common costs for generating that revenue. Two concepts are used in assigning and classifying expenses. First, each center is charged only with those costs directly traceable to the center. Second, costs charged to the center are subdivided between the categories of variable costs and fixed costs.

- A responsibility accounting system shows the performance of the center under each manager’s control.

- BusinessAccountingDistinguish between a traceable fixed cost and a common fixed cost.

- For example, a company might have numerous different divisions under which they are meant to serve numerous different areas.

- Each category has its characteristics that help in understanding the cost structure and making more informed decisions.

- Quick Check How much of the common fixed cost of $200,000 can be avoided by eliminating the bar?

- Common fixed costs are not allocated to a particular segment since they are common costs.

Analyze the facts in the scenarios and develop appr … Warehousing And Material Handling Effect Of Product Characteristics to Packaging and Materials Handling Considerations The difference in products in term of … You just lose out on some sales because you do all the special order.

Definition of “Traceable Fixed Expenses”

On the other hand, traceable fixed costs are incurred as a common denominator, irrespective of different departments existing within the company. These are the costs that are incurred regardless of different operations existing within the business domain. The overall costs incurred by a firm may be classified into different categories on the basis of the analysis being considered. Examples of classifications are direct costs & indirect costs, traceable costs & common costs, product costs & period costs.

What is an example of a common cost?

Example of a Common Cost

The cost of rent for a production facility is not directly associated with any single unit of production that is manufactured within that facility, and so is considered a common cost.

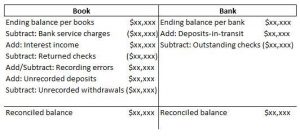

Since sales revenue and variable costs are typically driven by units sold these items can be easily traced to a particular segment. For example, it is easy to determine if a sale was a social media game or a cell phone game. Allocating traceable fixed costs is straightforward. Companies assign the whole amount for the expense to the responsibility center to which it relates. However, common fixed costs do not originate from a specific area.

The individual stores are considered segments within the organization. Graeters might also look at the profitability of product lines across all locations. In this case, the data would be segmented by product lines, such as ice cream and bakery items.

Following paragraphs define explain these two types of fixed costs. To stress the importance of a segment’s contribution to indirect expenses, many companies prefer the contribution margin income statement format. Notice how the indirect fixed costs are not allocated to individual segments. Indirect fixed expenses appear only in the total column for the computation of net income for the entire company.

Indirect Traceable Costs

In the next chapter, we introduce the topic of budgeting. The budget provides one of the major standards with which current performance is compared. A contribution margin income statement for the total company and an example of the company’s segments are presented in Exhibit 5-1.

- Opportunity costis the benefits of an alternative given up when one decision is made over another.

- During the suspension of production or other activities, certain costs may still need to be incurred, and these are considered ‘shut-down costs’.

- Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

- Fixed costs donot vary with the number of goods or services a company produces over the short term.

So the landing fee is common cost for these three class of passengers and is a traceable cost for the flight as a whole. Controlling traceable fixed costs is straightforward as they relate to a specific segment or center. However, the same does not apply to common fixed costs. Since many factors contribute to the latter category, controlling and eliminating them is more challenging. Traceable fixed costs, the meaning of this type of cost, and the distinction between traceable and common fixed costs are relevant in segmented financial reporting.

What are traceable costs?

A traceable cost is a cost for which there is a direct, cause-and-effect relationship with a process, product, customer, geographical area, or other cost object. If the cost object goes away, then the traceable cost associated with it should also disappear.